COGS Tax is a plugin for WooCommerce which calculates tax based on the margin (product price – cost of goods) instead of the full product price on a global or per product basis.

Features

- Calculate tax based on margin (price – COGS) instead of full product price

- Works with both cart and order calculations

- Global setting to enable/disable margin-based tax for all products

- Per-product setting to override global setting for individual products

- Support for simple products and variations

- Quick edit and bulk edit support

- HPOS (High-Performance Order Storage) compatible – Works with WooCommerce’s new order storage system

- Cart & Checkout Blocks compatible – Works with WooCommerce block-based checkout

- Compatible with WooCommerce COGS (Cost of Goods Sold) feature

- Automatically handles products without COGS values (falls back to standard tax calculation)

- Works with standard and custom tax rates set globally and per product

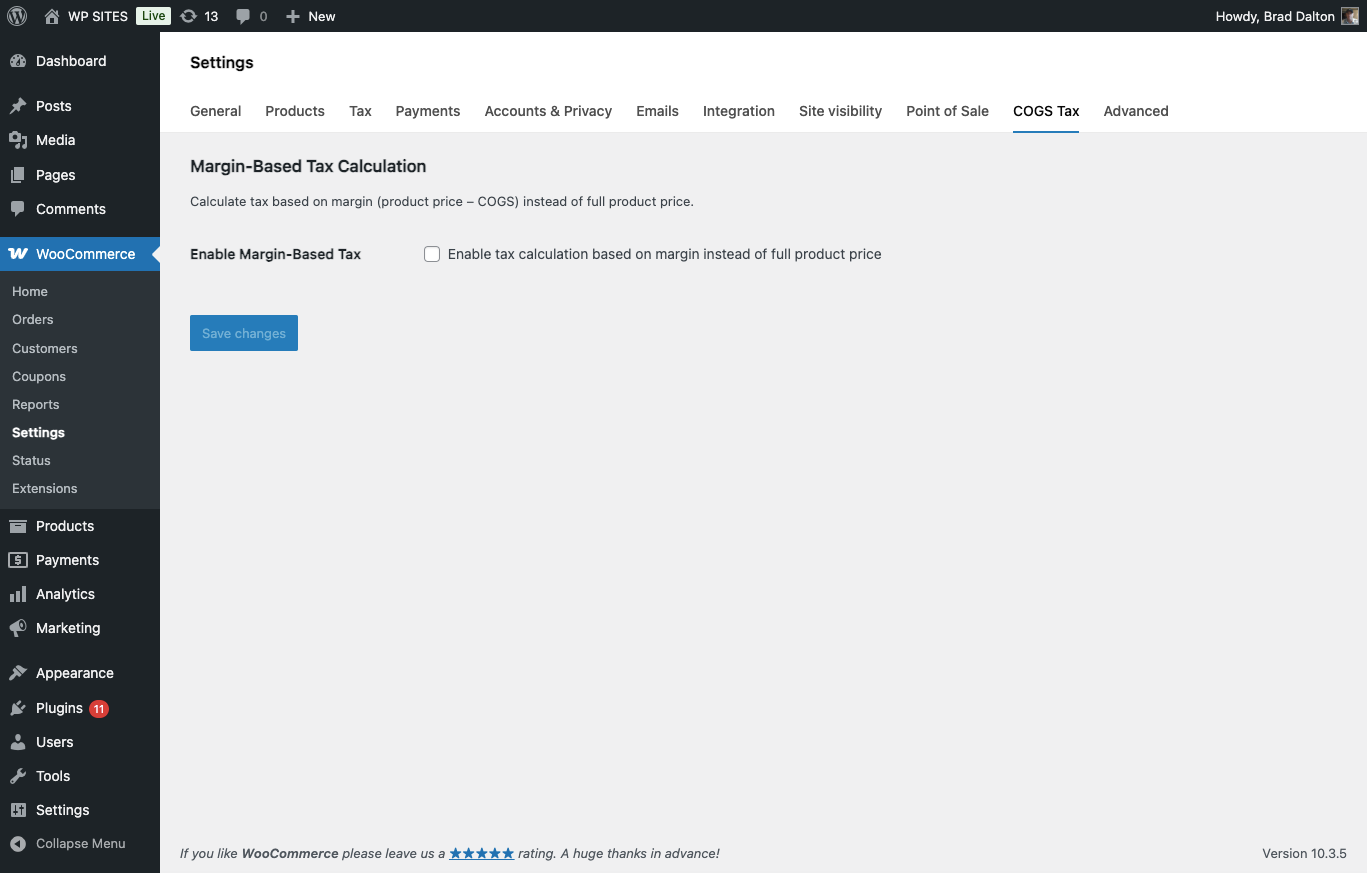

Global Setting

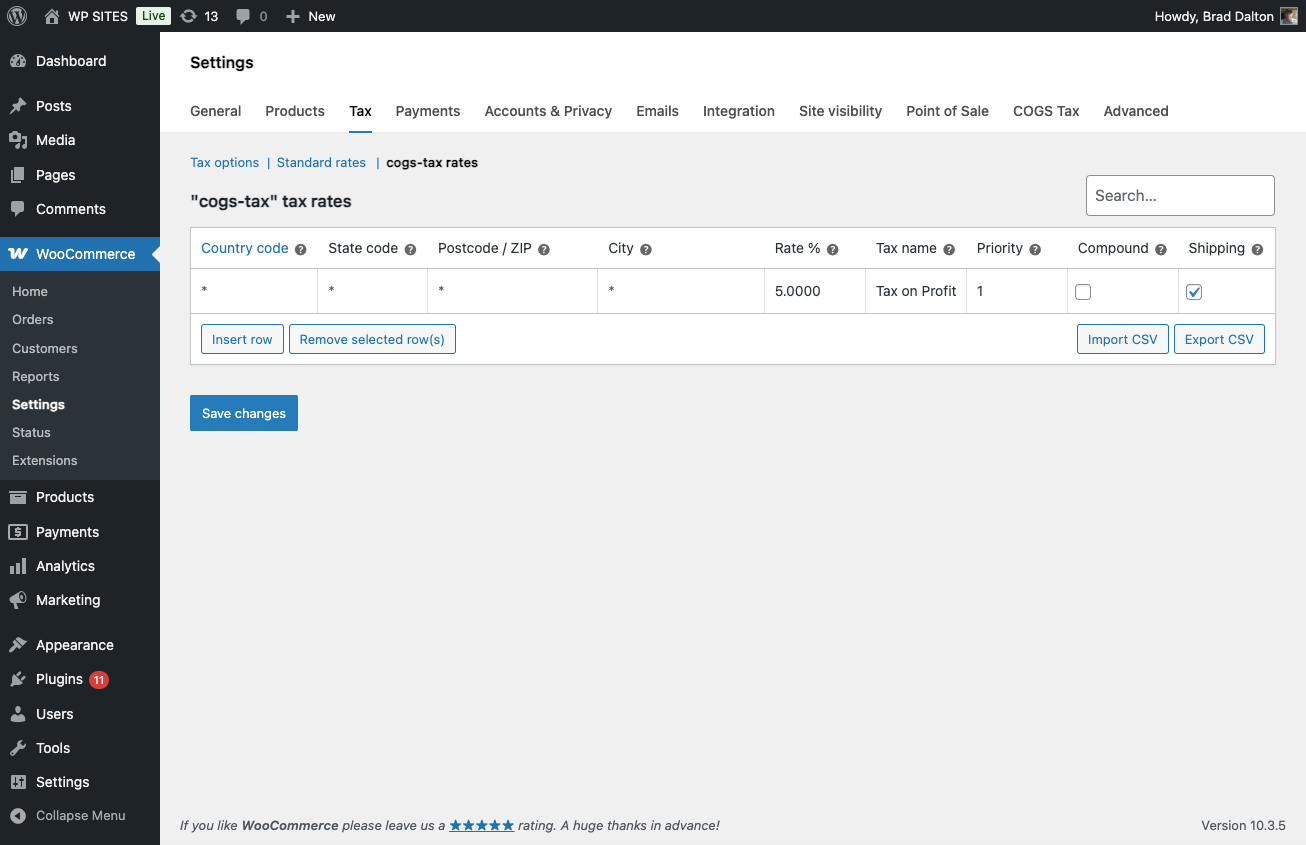

- Navigate to WooCommerce > Settings > COGS Tax

- Check the “Enable Margin-Based Tax” option

- Click Save changes

This will enable margin-based tax calculation for all products by default.

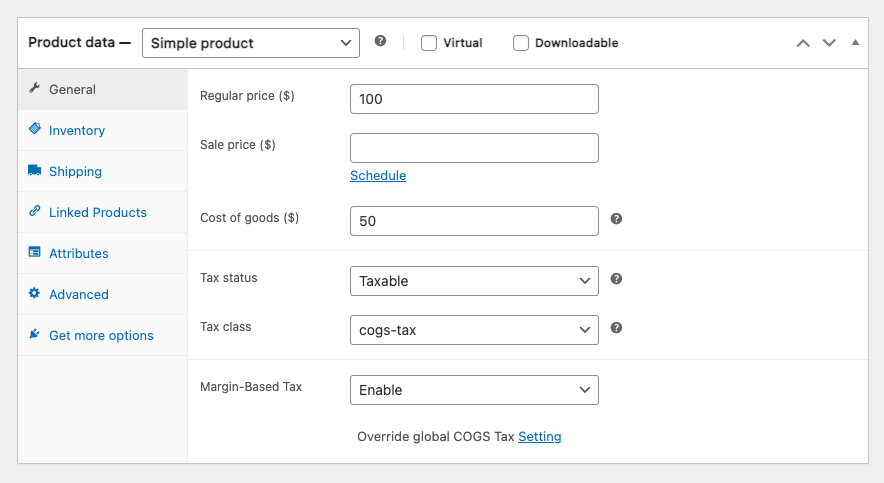

Per-Product Setting

- Edit a product in Products > All Products

- In the General tab, find the “Margin-Based Tax” dropdown

- Choose one of the following:

- Use global setting – Follows the global setting (default)

- Enable – Always use margin-based tax for this product

- Disable – Never use margin-based tax for this product

4. Click Update to save

Note: Per-product settings override the global setting. This allows you to have some products with margin-based tax and others with standard tax calculation.

How It Works

When enabled, the plugin:

- For each product in the cart or order, calculates the margin:

Product Price - COGS Value - Uses this margin amount as the taxable base instead of the full product price

- Calculates taxes on the margin amount

- Restores original prices after tax calculation

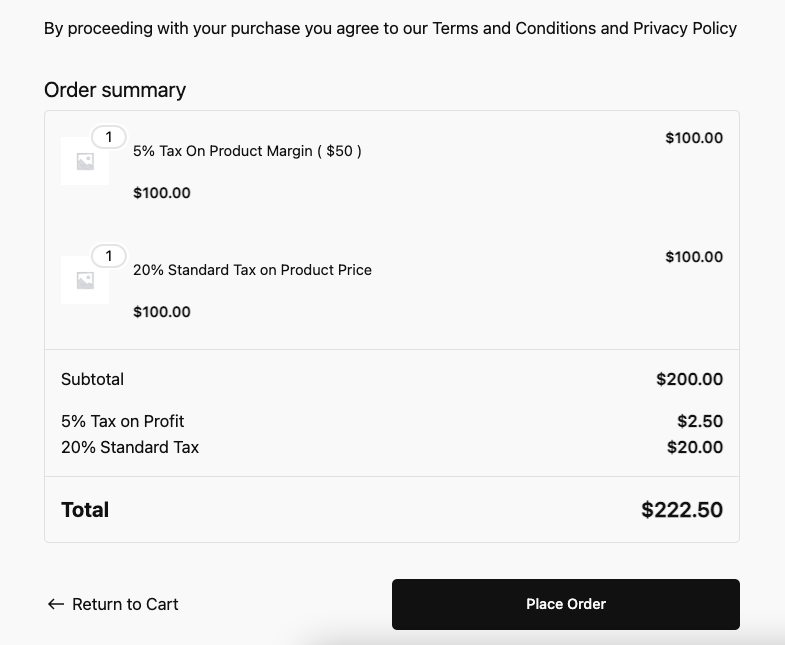

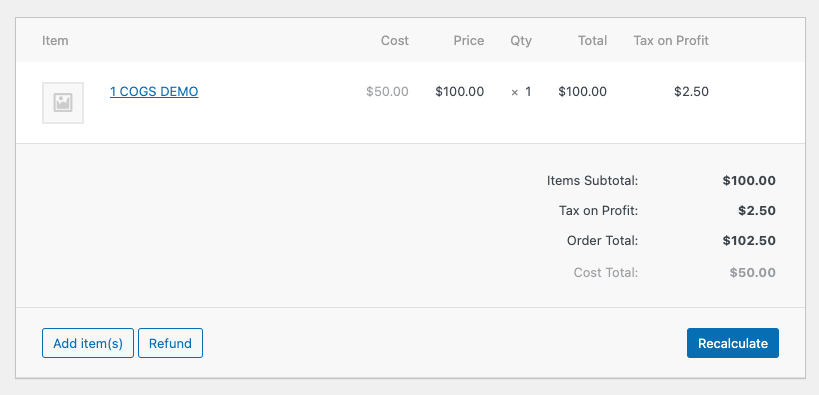

Example:

- Product Price: $100

- COGS: $50

- Margin: $50

- Tax Rate: 5%

- Tax Amount: $2.50 (instead of $5 on regular product price)

Reviews

There are no reviews yet.