This tutorial will walk you through setting up margin-based tax calculation using the COGS Tax plugin for WooCommerce.

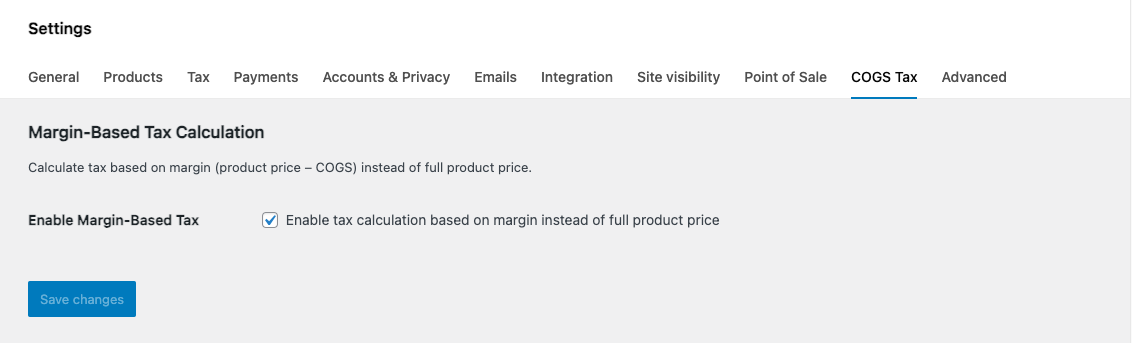

STEP 1 : Enable the COGS Tax Plugin

- Go to WooCommerce > Settings > COGS Tax

- Check the box next to “Enable Margin-Based Tax”

- Click “Save changes”

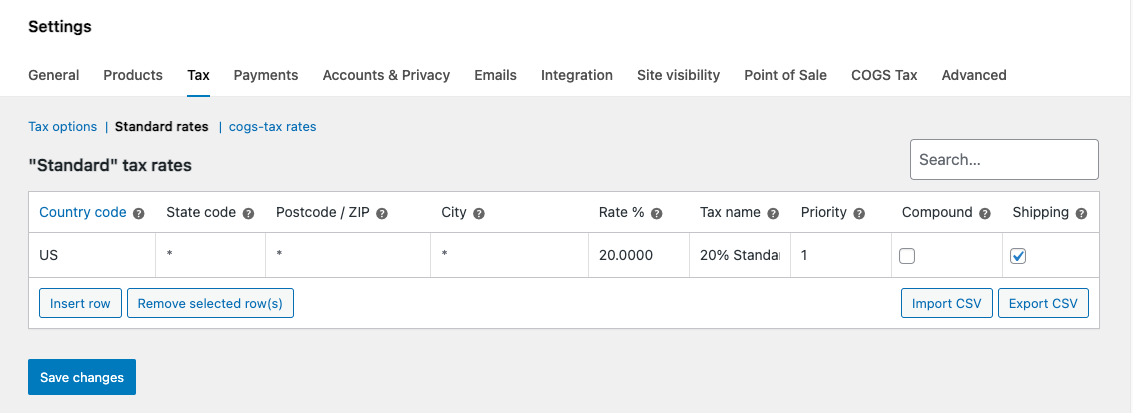

STEP 2 : Set Up Standard Tax Rates

- Go to WooCommerce > Settings > Tax

- Click on the “Standard rates” tab

- Click “Insert row”

- Fill in the tax rate details:

- Country code: Enter country code (e.g., US)

- State code: Enter state code (e.g., CA) or leave blank for all states

- Postcode/ZIP: Enter specific ZIP codes or leave blank for all

- City: Enter specific cities or leave blank for all

- Rate %: Enter the tax percentage (e.g., 8.5)

- Tax name: Enter a name (e.g., “Sales Tax”)

- Priority: Leave as 1 (unless you have compound taxes)

- Compound: Leave unchecked (unless this tax should be calculated on top of another)

- Shipping: Check if tax applies to shipping

5. Click “Save tax rates”

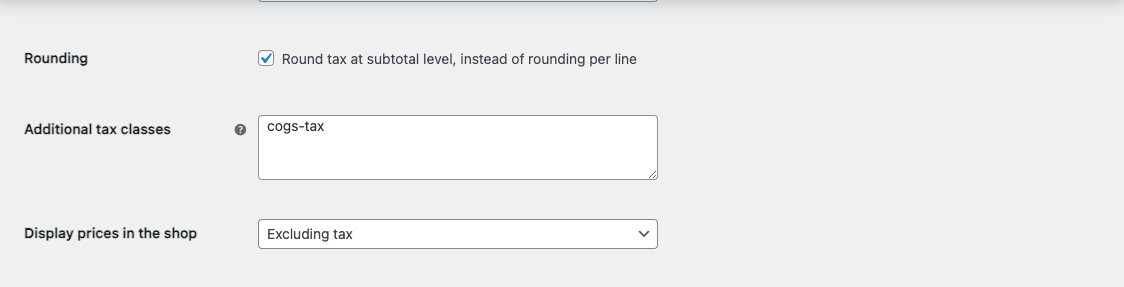

STEP 3 : Create a Custom Tax Class for Margin-Based Tax

- Go to WooCommerce > Settings > Tax

- Scroll down to “Additional tax classes” section

- In the “Add tax class” field, type a name (e.g., “cogs-tax”)

- Click “Add tax class”

- The new tax class will appear in the list

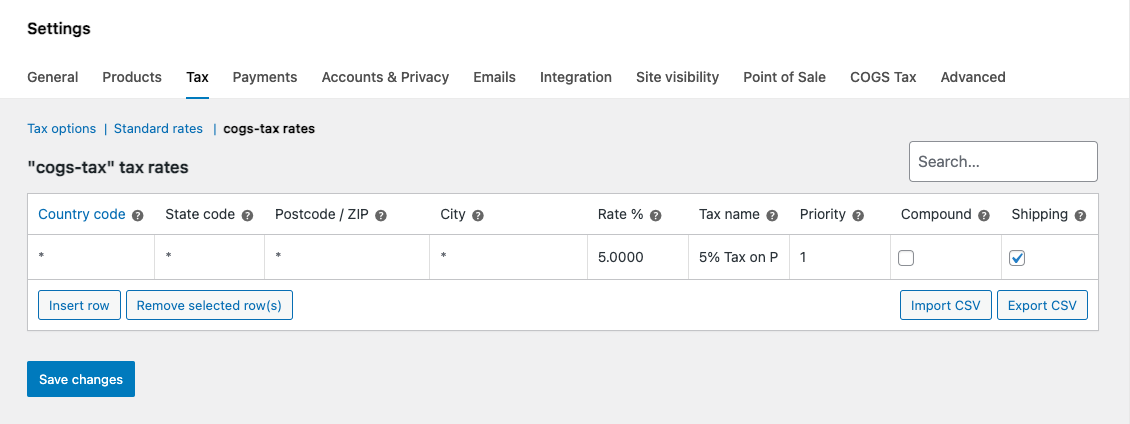

STEP 4 : Set Up Tax Rate for Your Custom Tax Class

A. Add a Tax Rate for Your Custom Tax Class (Margin-Based Tax)

- Go to WooCommerce > Settings > Tax

- Click on the tab for your custom tax class (e.g., “Tax on Profit”)

- Click “Insert row”

- Fill in the tax rate details:

- Country code: Enter country code (e.g., US)

- State code: Enter state code or leave blank

- Postcode/ZIP: Enter specific ZIP codes or leave blank

- City: Enter specific cities or leave blank

- Rate %: Enter the tax percentage for profit margin (e.g., 5)

- Tax name: Enter a name (e.g., “5% Tax on Profit”)

- Priority: Leave as 1

- Compound: Leave unchecked

- Shipping: Check if tax applies to shipping

5. Click “Save tax rates”

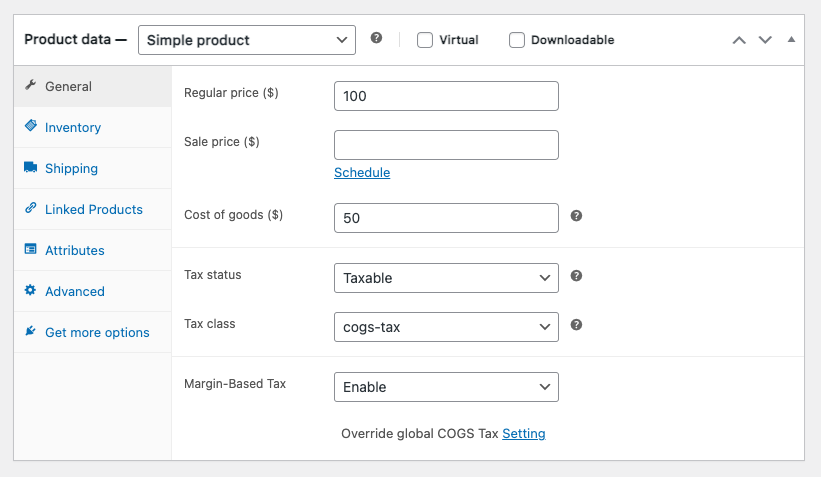

STEP 5 : Add COGS Value to Products

- Go to Products > All Products

- Click on a product to edit it

- In the product editor, find the “Product Data” section

- Look for the COGS (Cost of goods ($)) field

- Enter the cost value (e.g., 50 for a $100 product)

5. Click “Update” to save

STEP 6 : Configure Product Tax Settings

A. Set Product Tax Class

- While editing a product, go to the “General” tab

- Find the “Tax class” dropdown

- Select your custom tax class (e.g., “Tax on Profit”)

- Click “Update” to save

B. Configure Margin-Based Tax Setting for Individual Products

- While editing a product, go to the “General” tab

- Find the “Margin-Based Tax” dropdown

- Choose one of these options:

- “Use global setting” – Uses the setting from Step 1

- “Enable” – Always use margin-based tax for this product

- “Disable” – Never use margin-based tax for this product

4. Click “Update” to save

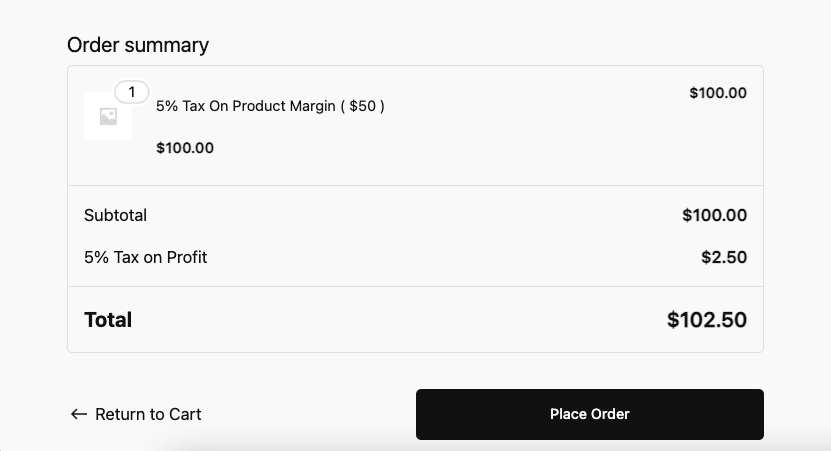

STEP 7 : Test the Tax Calculation

- Add the product to your cart

- Go to the cart page

- You should see:

- Subtotal: Full product price (e.g., $100)

- Tax: Calculated on margin only (e.g., if margin is $50 and tax rate is 5%, tax = $2.50)

- Total: Subtotal + Tax

Example Calculation:

Product Price: $100

COGS Value: $50

Margin: $100 – $50 = $50

Tax Rate: 5%

Tax Amount: $50 × 5% = $2.50

Total: $100 + $2.50 = $102.50

Without margin-based tax, tax would be calculated on full price:

Tax Amount: $100 × 5% = $5.00

Total: $100 + $5.00 = $105.00

STEP 8 : Bulk Edit Products (Optional)

- Go to Products > All Products

- Select multiple products using checkboxes

- Click “Bulk actions” dropdown

- Select “Edit”

- Click “Apply”

- In the bulk edit panel:

- Find “Margin-Based Tax” dropdown

- Select your desired setting

- Click “Update”

STEP 9 : Quick Edit Products (Optional)

- Go to Products > All Products

- Hover over a product and click “Quick Edit”

- Find the “Margin-Based Tax” dropdown

- Select your desired setting

- Click “Update”

TROUBLESHOOTING

- If tax is not calculating correctly, make sure:

- COGS value is set on the product

- Tax class is assigned to the product

- Margin-Based Tax is enabled (globally or per-product)

- Tax rates are properly configured

- WooCommerce tax settings are enabled

- If you see the full product price being taxed instead of margin:

- Check that Margin-Based Tax is enabled in plugin settings

- Verify the product has a COGS value

- Check the product’s Margin-Based Tax setting

SUPPORT

For additional help, contact: plugins@wpsites.net

Was this helpful?

Thanks for your feedback!

Leave a Reply

You must be logged in to post a comment.